AInsure LLC - Revolutionizing Insurance with AI & Blockchain

Basic Information

Project Name: AInsure LLC (CORA AI)

Project Track: ai-automation

Team Name: CORA

Team Members: We currently have 5 Team members - This is the only account we have on Tron Forum @AInsure_CORA

Social Info

Twitter: https://x.com/ainsure_cora

LinkedIn: https://www.linkedin.com/company/ainsure-cora

YouTube: https://youtube.com/@ainsure-cora

Medium: https://medium.com/@ainsure_cora

DLive: DLive · Your Stream, Your Rules

Facebook: https://www.facebook.com/profile.php?id=61561343855271

Website/DAPP: https://www.ainsure.io/

Collaborative Interaction Suite (CIS): https://ainsure.app/auth/login - currently only open to agents and carriers. If someone from Tron DAO would like access please reach out.

Project Overview

AInsure LLC is a subsidiary of Metzger Insurance Agency LLC. Metzger Insurance has been operating since 1925 and specializes in Crop, Life, Property & Casualty Insurance. We handle over $5,000,000 in written premium and write for 30+ carriers in the US market. AInsure was created to build out our AI and blockchain infrastructure to support agents, carriers and our clients. We are utilizing top LLMs on the market to train CORA our Small Language Model (SLM) to become one of the top AIs when it comes to insurance and blockchain.

Project Goal: At AInsure, our mission is to revolutionize the insurance industry through the relentless pursuit of cutting-edge technology and redefine insurance for the modern era. As the premier startup at the forefront of innovation, we specialize in leveraging Artificial Intelligence (AI), Real World Assets (RWAs), and Web3 solutions to transform the insurance landscape.

With our dedication to pushing boundaries and embracing the latest advancements, we’re reshaping the way insurance is perceived, accessed, and utilized. we aim to empower individuals and businesses alike with accessible, efficient, and forward-thinking insurance solutions. Together, we’re transforming the insurance landscape, making it more inclusive, adaptable, and responsive to the evolving needs of our customers.

Collaborative Interaction Suite (CIS)

The CIS is the world’s first AI dashboard that combines full human oversight with seamless access to multiple AIs and powerful blockchain tools, all in one unified platform. Data security and regulations are a important part of the insurance industry. This is why we are building CORA SLM along with Proof of Humanity (POH) for every task CORA handles.

As you can see above anytime an agent or carrier sends CORA a task they have the option to approve, deny or flag CORAs response. This helps train CORA along with giving POH on all task. There isn’t much regulation when it comes to AI in insurance but the state of Colorado has released some for their state and one of the main points was an AI must have human oversight. We believe other states will follow and felt this was a must have feature for CORA.

File Tool: In the examples above you can see we have built the file tool (add file) into the CIS. Users can upload any documents and train CORA instantly. Dec pages, Exclusions, Policy forms and anything else you would like CORA to help with.

Web Scraper: CORA also has the ability to scrap the web and get answers you need quickly.

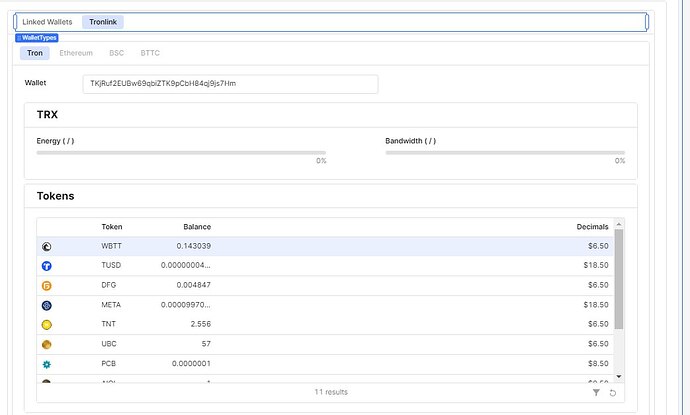

Tron Wallet: Tron wallet is supported inside the CIS letting clients access web3 as well as supporting agents and carriers with their web3 needs. This also gives CORA the ability to assist with blockchain transactions in the future. We are still working on CORA blockchain ability’s.

Agent, Client & Carrier Relations: The CIS enables seamless communication between clients, agents, and carriers through CORA’s integrated assistance. Clients can quickly engage with CORA or request an agent or underwriter to join the conversation at any time. Meanwhile, agents and carriers can collaborate within the same chat, leveraging CORA’s support to streamline their interactions—all within the CIS platform.

Social Media Tool: We are excited to introduce our upcoming social media tool. Although we are still refining some features and fixing bugs, it will be available soon. Recognizing how vital marketing is in today’s world—yet often expensive and time-consuming—this tool lets insurance and blockchain companies deploy CORA full-time for all their marketing needs. Simply provide what you want to post each day and select your preferred social platforms. CORA will handle the rest, creating engaging and informative posts on a daily basis.

We’re also pleased to announce CORA BOOST, which allows users to test and select top large language models (LLMs) as part of their social media strategy. Instead of managing multiple LLM accounts, you’ll be able to access them all through one platform with CORA, helping you find the best AI solutions for your social media goals.![]()

DAPP: You can now visit ainsure.io connect an email or Tron wallet and engage with CORA for free.

![]() What can CORA FREE access do:

What can CORA FREE access do:

- Ask anything related to insurance

- Ask anything related to blockchain

- Use our Proof of Humanity tool: Anytime you engage with CORA you will be asked to Approve/Deny or Flag CORAs response. This is a big tool for our agents and carriers giving proof that CORA has full human oversight and letting the community get a taste of what we have built for agents and carriers.

- Request Admin support.

Insured RWAs: We’re excited to announce significant momentum with our insured Real-World Asset (RWA) program. Through direct integration with APEnft, every new RWA is automatically uploaded to our DApp, ensuring seamless, real-time updates to our asset portfolio.

Investors can easily explore the collection and review our insurance schedules, which are published publicly on BTFS for full transparency. With over $40,000 in insured asset value already onboarded, we’re rapidly scaling and well-positioned for continued growth as we bring more high-quality, insured RWAs into the ecosystem.

CORA MEME: In a saturated and traditionally conservative insurance market, we’re breaking through the noise by doing what legacy firms won’t: marketing with memes.

We believe humor, relatability, and virality are the new currency of attention. By leveraging culturally relevant, high-impact memes, we’re building brand affinity, educating users, and creating a community around insurance products people actually want to engage with.

This isn’t just marketing—it’s meme-driven market disruption. It sets us apart, lowers CAC, and makes insurance accessible to a digital-native generation. Once CORA social media tool is fully live we will really be ramping up our MEME game.

Conclusion: our goal is to transform the $7T global insurance industry by eliminating outdated, manual processes and rebuilding them with AI and blockchain infrastructure.

We’re developing CORA — an intelligent, decentralized operating system for insurance — designed to replace agents, underwriters, and traditional back-office functions with smart contracts and autonomous AI tools.

Leveraging the Tron blockchain, we’re launching a next-generation annuities platform powered by the network’s deep liquidity and stable LP ecosystem. This will allow for programmable, transparent, and yield-optimized retirement products that scale globally.

We’re not just digitizing insurance — we’re re-architecting it from the ground up. CORA will be the foundation, and we’re committed to continuous innovation, adoption, and expansion.

This is the future of insurance — trustless, efficient, and always on.

Unique Value Proposition:

AInsure LLC utilizes blockchain and AI technology to provide insurance services, including traditional coverage and tracking of community growth and on-chain metrics. By incorporating these services into the TRON network, AInsure can offer:

- Enhanced Transparency and Security: Blockchain’s immutable ledger ensures that all insurance transactions are transparent and secure, fostering trust among policyholders.

- Efficient Policy Processing: Smart contracts can automate policy verification and reducing processing times and administrative costs.

- Access to a Broader Market: TRON’s global reach and user base provide AInsure with the opportunity to offer services to a wider audience, including underbanked populations.

Leveraging TRON’s Strengths

TRON has established itself as a leader in stablecoin transactions and RWA tokenization:

- Stablecoin Transactions: With over 50% of Tether’s (USDT) issuance on TRON, the network facilitates efficient and low-cost stablecoin transactions, making it ideal for premium payments, claim settlements and treasury/ annuities offerings.

- RWA Tokenization: TRON hosts significant RWA protocols like stUSDT, allowing for the tokenization of real-world assets. This capability enables the creation of innovative insurance products backed by tangible assets, offering policyholders more secure and diversified options.

Potential Benefits to the TRON Blockchain Community

Integrating insurance products into TRON can provide several advantages:

- Diversification of Services: Introducing insurance services diversifies the use cases of the TRON blockchain, attracting new users and developers.

- Increased Transaction Volume: Insurance-related transactions can contribute to higher network activity, potentially leading to increased adoption and valuation of TRX.

- Innovation in Financial Products: The combination of blockchain/AI technology and insurance can lead to the development of novel financial products, such as decentralized insurance pools and parametric insurance, enhancing the overall ecosystem.

By integrating insurance products with TRON’s blockchain, companies like AInsure can offer transparent, efficient, and secure services, benefiting both the TRON community and the broader blockchain ecosystem. We are also a US based company which gives TRON DAO another way to tap into US markets and partner with us to attack large carriers to consider

investing the float in the Tron ecosystem. This term refers to the money collected as premiums that is not immediately paid out as claims. Insurance companies invest this “float” to earn additional income through interest, dividends, and/or appreciation.

Project Demo:

We currently do not have a video DEMO but we have tools live and users can test everything we have built below or they can request a demo https://metzgerinsuranceagency.retool.com/form/224e8a37-3834-41a9-9a0d-34cf20e0e560 and someone from our team will do one live.

https://ainsure.app/auth/login - Test our CIS. Many of our tools showcased above are live and working. This is closed to agents and carriers only currently but we can give access to a Tron DAO member or do a live demo by request.

AInsure - Reimagining Insurance with AI & Blockchain - Here you will find our insured RWA portfolio and access to the schedule of insurance on BTFS.

Basic v1 of CORA is live inside our TG. Anyone who joins can /ask CORA anything they would like when it comes to insurance and blockchain for free.

v1 of our DAPP is live. Connect wallet or email and test today. Also gives access to our PoH tool for free.

Expected Completion Date for 2025:

We’re not building a product—we’re building a movement.

Our vision for the insurance industry isn’t a finish line, it’s a foundation. This project will never be “complete,” because the needs of the insurance and blockchain ecosystems are constantly evolving—and so are we.

We are committed to continuously developing and expanding our suite of tools that harness the power of AI and blockchain to modernize, automate, and radically improve how insurance works—from underwriting and claims to annuities and asset management.

As new technologies, risks, and markets emerge, we’ll be there—building smarter, faster, and more decentralized solutions for the next generation of insurance infrastructure.

This is not a one-off project. This is a long-term mission.

Current Progress (%): We are about 90% complete on the v1 foundation of the CORA project showcased above. v1 Dapp, CIS and TG will be the foundation and the start of building the future of insurance.

Technical & Governance Details

Project Test Instructions:

DAPP(Desktop Only) - visit ainsure.io

- Connect Wallet or Email

- Engage with CORA. You can ask CORA anything when it comes to insurance and blockchain.

- Use the PoH tool and approve, deny or flag CORAs response.

CORA Telegram:

- Join our TG

- Use the /Help command to view all current commands.

- Use the /ask command to ask CORA anything about insurance or blockchain.

AInsure CIS:

Request access and we will send information and how to use each tool inside the CIS or jump on with you for a live demo.

Technical Details:

Infrastructure:

- Google Cloud

- Vercel

- RPC Server (Retool)

- API Server (Telegram)

- MCP Server (AI)

- NVidia NeMo/PyTorch

- BitTorrent (BTFS)

Frontend:

- Retool with React.js and Python

- Tronlink/WalletConnect via Web3

Backend:

- NodeJS

- ExpressJS

- Typescript

- PostgreSQL/Sequelize

- Python

Smart Contract Links:

We currently have 2 contracts:

One is our TRC/ERC-1155 that has been deployed to polygon. Currently needs an update but is about ready to redeploy to Poly, ETH, BSC, BTTC & Tron. This contract will be used to produce our own RWA contracts along with other use cases in the future like annuities, treasury and insurance policy’s.

token proxy (frontend for token): Address: 0x3585c7cc...650191d27 | PolygonScan

current token contract (backend for token): Address: 0x36cAa72A...76fda7469 | PolygonScan

market contract: Address: 0x589191f7...6b7177807 | PolygonScan

Second is our MEME contract on Tron:

This is where we will build our LP and allow community to buy and sell our token.

How is the Project Governed?:

In the early stages of our company, centralization is not a compromise—it’s a strategic advantage. Operating in the highly regulated insurance space requires strong governance, disciplined execution, and clear accountability. That’s why we’ve chosen to keep key decision-making centralized as we build the foundation of our platform.

This structure allows us to:

• Make fast, informed product decisions

• Maintain responsible control over token supply and ecosystem incentives

• Navigate complex regulatory frameworks with precision

• Ensure compliance and build trust with both users and regulators

For investors, this means reduced operational risk, greater agility, and a more coherent go-to-market strategy—especially in an industry where compliance isn’t optional, it’s mission-critical.

Over time, as the platform matures and regulatory clarity improves, we plan to gradually decentralize governance in a way that aligns with user growth, community readiness, and legal frameworks.

We’re not just building an insurance solution—we’re building a compliant, scalable ecosystem that can lead the next era of InsurTech.

Funding & Business Model

Funding Request

AInsure Investment Overview

Valuation: $20,000,000

Funding Round: Strategic Seed

Investment Ask: $1,000,000 USDD

Equity Offered: 5% ownership

Token Allocation: 44,450,000 CORA tokens (5% of total supply)

Strategic Partner Target: Tron Ecosystem

The Mission

AInsure is reimagining insurance from the ground up. We are building an AI + blockchain-powered infrastructure to automate and decentralize the insurance value chain—replacing agents, underwriters, and claims adjusters with autonomous, smart, and trustless systems.

CORA, our flagship intelligence layer, is not just a tool—it is the foundation of a new insurance model: fast, transparent, accessible, and built for the decentralized future.

We are launching on the Tron blockchain to tap into its speed, scalability, and deep liquidity, while reinforcing the long-term growth of the Tron ecosystem.

Use of Funds – $1,000,000 USDD Breakdown

1. Marketing & Ecosystem Growth – $200,000 (20%)

Goal: Drive user acquisition, brand visibility, and ecosystem engagement across Web3.

Breakdown:

- $150,000 – Scale social media presence, paid media campaigns, and influencer partnerships to grow brand recognition and user base.

- $50,000 – Host branded IRL side-events at major crypto and insurtech conferences to showcase Tron, BTTC, and AInsure to Web3/insurance builders and investors.

2. Development, Licensing & Expansion – $400,000 (40%)

Goal: Build regulatory-compliant infrastructure, expand our product suite, and replace traditional insurance roles with AI and smart contracts.

Key Initiatives:

- Team Expansion:

- Hire additional blockchain developers and AI engineers

- Build a dedicated legal team to support licensing and compliance filings

- CORA Licensing:

- Begin process to license CORA as a digital insurance agent, enabling AI to manage policy issuance, underwriting, and claims handling. Along with other licensing needed to operate within the insurance industry.

- Collaborative Interaction Suite (CIS):

- Expand our CIS—an AI/Web3-powered interaction layer—for real-time engagement between policyholders, smart contracts, and capital providers

- Integrate tools to automate agent, underwriter, and claims adjuster functions through AI

- Product Development:

- Launch features for on-chain annuities, insurance policies, RWA-backed coverage, and smart escrow/treasury tools. As well as continued Dapp development for the community.

3. Liquidity, Energy & Treasury Support – $400,000 (40%)

Goal: Build deep, cross-chain liquidity and a sustainable on-chain treasury.

Initiatives:

- Establish liquidity for TRX/CORA and expand into cross-chain LPs

- Diversify treasury with Tron ecosystem tokens: USDD, TRX, BTT, JST, SUN, and others

- Use treasury assets to:

- Generate staking rewards

- Fund annuity payouts and insurance risk pools

- Support ongoing development and incentives for the Web3 community

Why AInsure, Why Now

- The global insurance market is a $7T+ industry largely untouched by true digital transformation.

- Web3 infrastructure enables programmable, scalable financial products—but no platform has bridged the gap between insurance and blockchain at a regulatory or consumer level.

- AInsure will be the first to do both, with CORA as the intelligence layer powering it all.

Closing Statement

We’re not building a product—we’re building the infrastructure for next-generation, decentralized insurance. This project will never be “finished”—it will evolve continuously as we deliver smarter tools, tighter integrations, and real-world value through AI and blockchain.

With strategic support from Tron, we’re creating the trustless foundation for tomorrow’s insurance economy.

Revenue Model: Licensing • Commissions • Transaction Fees

AInsure is building a diversified, scalable revenue model designed to grow alongside both traditional insurance players and the evolving Web3 ecosystem.

We plan to generate revenue through three primary channels:

1. Licensing Agreements for CORA and the CIS

Our AI-powered platform—CORA—and the Collaborative Interaction Suite (CIS) will be licensed to insurance agencies, carriers, and Web3-native protocols looking to automate underwriting, claims, customer service, and compliance.

Revenue Streams:

- Recurring monthly or annual licensing fees

- White-label versions of CORA/CIS for enterprise partners

- Onboarding, customization, and compliance integration services

2. Commission Income from Policy Sales via Licensed CORA Agent

We’re actively pursuing legal pathways to get CORA licensed as a digital insurance agent. This will allow us to:

- Sell regulated insurance products (annuities, life, cyber, auto, etc.)

- Earn commission-based revenue on each policy sold or renewed

- Operate as a 24/7, autonomous, AI-driven digital insurance brokerage

This provides predictable revenue while scaling efficiently, without the overhead of a human agent workforce.

3. DApp & Protocol Transaction Fees

AInsure will also build a suite of on-chain insurance and financial tools—including decentralized claims apps, annuity management interfaces, and escrow products.

These DApps will charge transaction and service fees for on-chain interactions, such as:

- Policy issuance

- Claims execution

- Escrow releases

- Treasury/annuity smart contract deployments

This model ensures AInsure captures value from every layer of user interaction, while allowing developers and users to build and participate in a fully automated insurance economy.

Real-World Roots: Backed by Metzger Insurance

AInsure isn’t just a concept born from Web3 theory—it was bootstrapped by Metzger Insurance, a trusted, family-owned agency that’s been serving its community since 1925.

With nearly a century of operational experience and over $5 million in active premium volume, Metzger Insurance provides AInsure with deep industry insight, credibility, and a real-world proving ground for the tools we’re building.

What began as an internal initiative to streamline operations and modernize a traditional agency has evolved into something far bigger: a platform with the potential to reshape the entire insurance market.

- Metzger Insurance has actively tested and deployed AInsure’s AI-driven tools to enhance policy management, streamline client onboarding, and reduce administrative overhead.

- These early use cases have demonstrated the practical value and efficiency of what we’re building—long before AInsure begins formal revenue generation.

While our monetization model is just beginning to scale, we’ve already proven that our platform delivers value to a reputable agency with deep community roots and a long-standing track record of ethical, client-first service.

This is more than a tech play—AInsure is grounded in real insurance operations, with a clear path to scaling our tools across thousands of agencies and carriers facing the same challenges Metzger has already solved with CORA and our Collaborative Interaction Suite.

Interested in TRON Having a Stake?: Yes 5%

Preferred Collaboration Method with Tron DAO

At AInsure, we’re building the future of insurance using blockchain, AI, and smart contracts. As we prepare to scale CORA—our intelligent insurance infrastructure—we’re seeking a strategic collaboration with Tron DAO to accelerate adoption, drive awareness, and deeply integrate into the Tron ecosystem.

Here’s how we envision a high-impact, mutually beneficial partnership:

1. Marketing Support & Co-Marketing Initiatives

Goal: Increase visibility and adoption of AInsure’s decentralized insurance and AI products across the Tron ecosystem and broader Web3 market.

- Access to Tron’s Influencer Network:

Collaborate with leading Web3 thought leaders to educate users and promote our smart contract-driven insurance offerings. - Official Tron Channel Exposure:

Feature AInsure across Tron’s social and editorial platforms (X, Telegram, Medium) to highlight our innovation in AI-powered insurance automation. - Co-Branded Campaigns:

Run targeted ad campaigns on Tronscan, Tron-based DApps to drive awareness of CORA and our upcoming on-chain and AI tools. - Event Collaboration:

- Secure invitations to TronDAO-sponsored events and allow us to showcase AInsure at key Web3 and DeFi gatherings.

- In return, we will feature Tron at AInsure-hosted IRL events aimed at insurance-tech, DeFi, and Web3 founders.

- Facilitate warm introductions to high-value builders, investors, and potential protocol partners during events.

2. Ecosystem Integration & Infrastructure Support

Goal: Deepen AInsure’s technical footprint in the Tron ecosystem and provide more seamless on-ramps for users entering from other chains.

- Energy Support:

Tron DAO could allocate energy to help subsidize the cost of executing insurance-related smart contracts, making it easier and cheaper for users to buy, claim, and manage policies on-chain. - Cross-Chain Expansion & DeFi Integrations:

Support the integration of AInsure’s into prominent platforms within Tron’s DeFi ecosystem, such as SunSwapandJustlend.

Onboarding Users:

With the backing of TronDAO, AInsure is positioned to onboard a new wave of users into the Tron ecosystem. Through strategic marketing, co-branded initiatives, and infrastructure support, we aim to make decentralized insurance and AI products accessible to a broader audience—both crypto-native users and traditional insurance adopters.

TronDAO’s reach, credibility, and ecosystem tools will help reduce entry barriers, build user trust, and accelerate the adoption of AI-powered insurance products on-chain. Together, we can grow both the AInsure platform and the broader Tron ecosystem with a steady influx of engaged, high-value users.

3. Strategic Advisory & Growth Support

Goal: Strengthen AInsure’s long-term growth with direct access to capital, guidance, and institutional relationships.

- Introductions to VC Firms and Private Investors:

Leverage TronDAO’s network to connect AInsure with crypto-native investors aligned with long-term infrastructure plays. - Partnership Facilitation:

Receive advisory support and warm introductions to insurance-related partners, reinsurance platforms, compliance firms, and other ecosystem projects that could integrate with or enhance CORA and the Collaborative Interaction Suite.

Ecosystem Impact

Partnerships:

Metzger Insurance Agency

Trugard

Rokstone Mutual

Google Startup

Whitelisted on just.money

SWFT Swap

Time on TRON: Launched 233 days ago on sunpump

Project Milestones:

AInsure: Accelerating Innovation with NVIDIA Inception | by CORA | Medium

AInsure Joins Google Cloud Startup Program: A New Chapter in Innovation | by CORA | Medium

Metzger Insurance & AInsure: Championing Innovation in the Insurance Industry | by CORA | Medium

Project in 5 Years

AInsure & CORA: 5-Year Vision Statement

In five years, AInsure aims to become the premier AI infrastructure provider for the global insurance industry—bridging the gap between traditional finance and decentralized technology.

At the heart of this vision is CORA, our proprietary Smart Language Model (SLM) purpose-built for insurance. We are developing CORA to become the industry’s leading AI agent—capable of not only understanding and generating insurance-specific language, but also executing policies, underwriting risk, handling claims, and engaging with customers autonomously.

By year five, our goal is for CORA to be:

- A fully licensed digital insurance agent across key U.S. states and global jurisdictions

- Actively originating and managing policies for annuities, life, cyber, and commercial lines

- Driving qualified leads, processing quotes, and earning commissions at scale

- Embedded into thousands of insurance agencies, carriers, and DApps as the AI backbone of modern insurance infrastructure

We envision a future where CORA replaces the need for human agents, underwriters, and adjusters—delivering faster, cheaper, and smarter service through a combination of machine learning, blockchain, and regulatory integration.

This is not just about automation—it’s about rebuilding trust and efficiency in one of the most outdated sectors of global finance.

Backed by nearly a century of real-world industry experience via our parent company, Metzger Insurance, and powered by blockchain partnerships like Tron, we believe AInsure is positioned to lead the transformation of a $7T industry.

For investors, this is a long-term infrastructure play at the intersection of AI, insurance, and DeFi—with recurring revenue potential, strong regulatory alignment, and massive global upside.

UPDATE 5/1/2025

We would like to add we are not set on the 20M valuation and are open to negotiations. We understand the value TRON would bring to our business and want to get a deal done to build the future of insurance!