Project Name: Surity

Project Track: DeFi

Team Name: The Aresians

Team Member(s):

DevPost Project Link: https://devpost.com/software/surity

Project Info:

Github link : Surity | Decentralized Insurance Market · GitHub

Twitter link: x.com

Survey link: https://forms.gle/7bDrA7w1pUuxuZLn7

Pitch Deck: PitchDeck-Surity.pdf

Project Website: https://testnet.surity.marsian.dev

Test USDT Faucet link: https://surity-testnet-faucet.netlify.app

Project Goal:

We aim to develop a platform that allows insurance marketers to create and manage their custom insurance policies. Through our platform, insurance marketers will have the capability to design and customize insurance schemes.

To ensure transparency and reliability, the marketers can choose to add a public premium calculation function (in some programming language) which will be publicly visible to all potential buyers. This function will be responsible for calculating premiums for each policy based on specified parameters and risk factors. Additionally, the function will evaluate the eligibility of applicants and assess the feasibility of issuing policies, enhancing confidence in the fairness and accuracy of premium calculations.

Furthermore, there will also be an option to add a claim validation function designed to verify the legitimacy of claims submitted by policyholders. This function will utilize predefined criteria and automated processes to validate claims, thereby streamlining the claims adjudication process and minimizing the risk of fraudulent claims.

These policies will be made available for purchase through our web platform. Users will have access to a catalog of available policies, each having detailed information regarding coverage, premiums, terms and conditions and also the aforementioned functions for claim validation and premium calculation will also be public.

Project Value:

-

Transparency:

Blockchain technology ensures transparency by providing a decentralized ledger where all transactions and activities related to policy creation, premium calculation, claim validation, and fund utilization are recorded. This transparency instills trust among users as they can verify how policy marketers are investing funds, validating claims, and generating premium costs without relying on a centralized source. -

Liquidity:

Blockchain enables the creation of unique incentives for individuals willing to maintain liquidity for policy marketers. Through a staking system, users can stake tokens for their chosen policies, providing liquidity to the platform. Policy marketers can also choose where to invest the received funds, and this process can be automated using blockchain technology. This liquidity mechanism enhances the accessibility and efficiency of the insurance marketplace. -

Rewards:

Blockchain platforms inherently offer mechanisms for rewarding users. In our platform, users who stake tokens, regardless of the policy they choose, will be rewarded with SureCoins, our platform’s native tokens. These rewards are generated from the total initial token supply and are proportionately distributed based on the staking amount. To maintain token value and incentivize participation, tokens will be released monthly, with the percentage of the initial supply decreasing by 20% each month. -

Secure Function Execution:

While function definitions are public, the actual execution occurs in a secure and private server environment managed by us.

User details, provided as function arguments, are not stored on the blockchain. Instead, a server executes the functions, signs the outputs, and our smart contract verifies the authenticity of the execution log before accepting premiums. This approach ensures data privacy and security while maintaining the benefits of transparency and decentralization.

Benefits of Blockchain and Decentralization:

-

Trust and Reliability:

Blockchain’s decentralized nature eliminates the need for a central authority, ensuring trust and reliability in the insurance marketplace. Users can confidently engage with the platform knowing that their transactions and interactions are transparent, immutable, and resistant to tampering or manipulation. -

Security:

Blockchain technology employs robust cryptographic techniques to secure data and transactions. This enhances the security of sensitive information such as personal details, policy terms, and financial transactions, reducing the risk of fraud or data breaches. -

Efficiency and Automation:

Smart contracts, a key feature of blockchain technology, enable the automation of various processes such as premium calculation, claim validation, and rewards distribution. This streamlines operations, reduces administrative overhead, and ensures timely and accurate execution of contractual agreements. -

Incentives and Rewards:

By leveraging blockchain’s tokenization capabilities, our platform can incentivize user participation and engagement through rewards and token-based incentives. This fosters a vibrant and active community while aligning the interests of stakeholders towards the platform’s success.

Project Test Instructions:

Connecting to the plaform

Connect the wallet by clicking on the Connect button on the top right corner

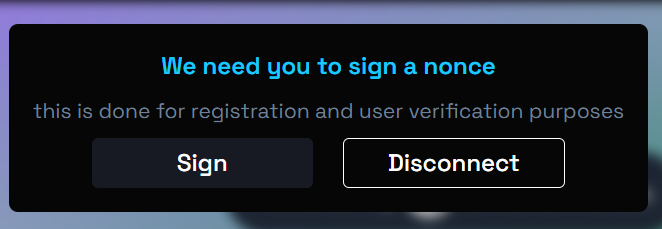

You will have to sign a Nonce to continue

Creating new policy

You will have to become a marketer on Surity to create new policy, head to settings from the side navbar and click on become Marketer

Provide details

After successfully becoming a Marketer, head over to Marketing from side navbar for creating new policies.

Provide simple details like name description minimum and maximum claim

Provide the premium calculation and claim validation function and their description. Ensure that it is a python function

You can also provide the description for arguments by clicking on the pencil icon

Provide details like tags, initial stakes

Click on Save, You will be needing FUSD for creating new policy, You can grab FUSD from the our Faucet.

Grab Fake USDT From this faucet: https://surity-testnet-faucet.netlify.app

Upon Succesful creation of the policy you will be able to see it details in All policies page

Project Details:

Highlighted below are few things we have in our mind regarding the scope of the project

User-Centric Functionality: :

- The platform serves two primary user roles: insurance providers and policyholders. Insurance providers offer various insurance policies, while policyholders purchase and benefit from these policies.

- Users have the option to stake in different insurance policies using a unique staking mechanism. For every USD contributed, users receive 1 platform token. They can withdraw their USD at any time.

- Monthly, a fixed amount of “surity tokens” is released to reward participants. 10% of these tokens are retained by the platform, to make profit and no tokens from the stakes / insurees would be taken as a fee, while the remaining tokens are distributed among stakeholders according to their stake ratios.

- Out of the initial supply, in the first month we will release 20% of the total supply then every consecutive month, we will decrease the released coins by 20% so it will go like, 20%, then 16%, 12.8% and so on…

- Marketers play a pivotal role by creating new insurance policies and providing transparent functions for premium calculation and claim validation. These functions are accessible to users, ensuring transparency and trust in the insurance process.

- Policy providers can also stake in other policies.

Customized Staking Mechanism and Policy Visibility:

- A custom form empowers users to specify conditions to stake in other tokens like Sol, Link, Eth, Trx. These conditions include triggers such as deposit into the pool through premium, deposit through staking, time duration, or general deposit into the pool.

- Additional conditions, such as specific amounts or ranges of received deposits, are configurable. Users can also specify the percentage of money to be staked and the target destination for their stake.

- Each insurance policy page provides visibility into the allocation of pooled funds and details of customized automated investments. Users can track how their stake is utilized and the automated investment strategy implemented for each policy.

Policies on Surity

Policy Page

Buy Policy

Account Page

Marketer Dashboard

Creating New Policy

Automated Token Investment

Smart Contract links:

-

Updated Surity Contract :

BTTCSCAN | BitTorrent (BTT) Blockchain Explorer -

Surity Contract : BTTCSCAN | BitTorrent (BTT) Blockchain Explorer

-

SureCoin Token : BTTCSCAN | BitTorrent (BTT) Blockchain Explorer

Project Milestones:

![]() Milestone 1 : Users can seamlessly interact with the platform to explore policies, register as users or marketers, create new policies, and access various functionalities with ease. The user interface is designed to be intuitive and user-friendly, ensuring a smooth experience for all consumers.

Milestone 1 : Users can seamlessly interact with the platform to explore policies, register as users or marketers, create new policies, and access various functionalities with ease. The user interface is designed to be intuitive and user-friendly, ensuring a smooth experience for all consumers.

![]() Milestone 2 : All smart contracts required for the operation of Surity have been successfully deployed. These contracts encompass the full spectrum of functionalities envisioned for the platform, including policy creation, premium calculation, claim validation, stake management, and more.

Milestone 2 : All smart contracts required for the operation of Surity have been successfully deployed. These contracts encompass the full spectrum of functionalities envisioned for the platform, including policy creation, premium calculation, claim validation, stake management, and more.

![]() Milestone 3 : Our backend infrastructure is operational and capable of supporting key functionalities of the platform. Users and marketers can be registered seamlessly through the backend system, and new policies can be created with a signatures to ensure security and authenticity. This backend setup lays a solid foundation for the secure and efficient operation of Surity, facilitating seamless integration with frontend and smart contract components.

Milestone 3 : Our backend infrastructure is operational and capable of supporting key functionalities of the platform. Users and marketers can be registered seamlessly through the backend system, and new policies can be created with a signatures to ensure security and authenticity. This backend setup lays a solid foundation for the secure and efficient operation of Surity, facilitating seamless integration with frontend and smart contract components.

![]() Milestone 4 : Integrate the functionality which is already being developed on the smart contract with the frontend and backend

Milestone 4 : Integrate the functionality which is already being developed on the smart contract with the frontend and backend

![]() Milestone 5 : Add functionality of Automated Investment of policy pool money in different tokens and integrate it with its already developed frontend. Make Surity fully functioning to support and work as an Telegram mini app

Milestone 5 : Add functionality of Automated Investment of policy pool money in different tokens and integrate it with its already developed frontend. Make Surity fully functioning to support and work as an Telegram mini app

![]() Milestone 6 : Implement Application and developer features within the Surity platform, enabling Developers to utilize the functionalities of Surity through APIs into their own applications. They can create their own websites which would list only their own policies. All these applications would be listed in the Application section to let consumers of Surity know about them.

Milestone 6 : Implement Application and developer features within the Surity platform, enabling Developers to utilize the functionalities of Surity through APIs into their own applications. They can create their own websites which would list only their own policies. All these applications would be listed in the Application section to let consumers of Surity know about them.