Project Name: AInsure

Project Track: Integration

Team Name: AInsure

Team Member(s): 5 only 1 account for our team @AInsure_CORA

HackerEarth Project Link: AInsure | Devpost

Project Goal: At AInsure, our mission is to revolutionize the insurance industry through the relentless pursuit of cutting-edge technology and redefine insurance for the modern era. As the premier startup at the forefront of innovation, we specialize in leveraging Artificial Intelligence (AI), Real World Assets (RWAs), and Web3 solutions to transform the insurance landscape.

With our dedication to pushing boundaries and embracing the latest advancements, we’re reshaping the way insurance is perceived, accessed, and utilized. we aim to empower individuals and businesses alike with accessible, efficient, and forward-thinking insurance solutions. Together, we’re transforming the insurance landscape, making it more inclusive, adaptable, and responsive to the evolving needs of our customers.

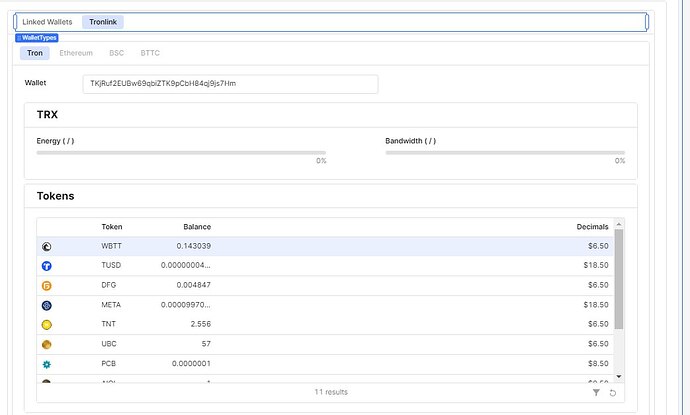

For Season 7 of the hackathon, our submission is focused on the Integration Track, where we aim to seamlessly incorporate TRON and TRON DeFi programs into our ecosystem. This integration will empower insurance agents and carriers with innovative tools to enhance their offerings and drive business growth. It also provides a secure and trustworthy platform for both new and existing clients to explore and understand TRON, Blockchain and DeFi technologies.

CORA, our AI, will act as a pilot within the TRON DeFi ecosystem, offering valuable education and support to help clients navigate the evolving DeFi landscape. By integrating tools like JustLend, Sun, BTFS, and TRON, we believe that having knowledgeable agents in their communities is the ideal way to foster learning and engagement in the world of DeFi and crypto. Join us on our journey to redefine insurance for the digital age and beyond.

Project Value: Integrating blockchain technology into the insurance industry presents a transformative opportunity for enhancing transparency, efficiency, and trust. By leveraging blockchain’s immutable ledger and decentralized nature, our project ensures that all transactions and data are securely recorded and verifiable, reducing fraud and increasing confidence in policy management and claims processing.

The integration of blockchain provides several key benefits:

- Enhanced Transparency and Security: Blockchain’s decentralized ledger offers unparalleled transparency and security, ensuring that all policy transactions and claims are tamper-proof and easily auditable. This not only mitigates the risk of fraud but also fosters trust between insurers and clients.

- Streamlined Operations: Automating and smart-contracting processes on the blockchain can significantly reduce administrative overhead, minimize errors, and speed up claim processing times. This leads to more efficient operations and improved customer satisfaction.

- Increased Accessibility and Innovation: By integrating with TRON and TRON DeFi programs, we offer new financial tools and services that expand the scope of insurance solutions. This integration opens doors to innovative products and financial strategies that enhance client value.

- Educational and Trusted Resources: Having trusted agents within their communities to educate clients about blockchain and DeFi tools adds an invaluable layer of support. These agents serve as knowledgeable resources, helping clients navigate the complexities of the crypto space and fostering a deeper understanding of new technologies.

- Enhanced Value for Agents and Carriers: The AInsure platform provides agents and carriers with an additional suite of tools and services that can drive business growth. By integrating blockchain and DeFi technologies, agents gain access to cutting-edge solutions that can attract new clients and offer innovative products, while carriers benefit from streamlined processes and increased operational efficiency. This added value supports their business expansion and positions them as leaders in the evolving insurance landscape.

- Disruptive Potential of Blockchain Reinsurance: Building a reinsurer on blockchain has the potential to revolutionize the industry by introducing a new level of transparency, efficiency, and trust in reinsurance transactions. Blockchain can streamline the reinsurance process by providing a decentralized, immutable record of all agreements and transactions. This could reduce operational complexities, lower costs, and improve the accuracy of risk assessment. The disruptive impact of such a system could redefine traditional reinsurance models, creating a more dynamic and responsive marketplace.

- Smoother Claims Process: Blockchain technology can significantly improve the claims process by automating and simplifying claims handling through smart contracts. These self-executing contracts automatically verify and process claims based on predefined criteria, reducing the need for manual intervention and accelerating claim approval times. This not only enhances the efficiency of the claims process but also reduces the potential for disputes and errors, leading to a more seamless and satisfactory experience for clients.

Incorporating blockchain into our insurance ecosystem not only modernizes operations but also builds a foundation of trust and reliability. Trusted agents play a crucial role in demystifying blockchain and DeFi, offering clients a reliable guide through these emerging technologies. This combination of cutting-edge technology and community-based education ensures that clients are well-informed, confident, and engaged, driving growth and innovation within the industry.

Project Info:

AInsure Whitepaper (2).pdf (465.8 KB)

(Keep in mind our tokenomics might be adjusted we are considering doing fair launch via sun pump)

Project Website:

ainsure.app

(Currently need to apply for approval to use our dashboard) (Please send us DM if your a Tron team member)

Telegram (Join our telegram we have CORA live there as well and users will be able to speak with CORA on a limited daily call amount)

Project Test Instructions: Testing our project is straightforward and user-friendly. Here’s how the judges and the community can explore our solution:

- Access via Dashboard:

- Get Approval: First, ensure you have been granted access to our dashboard.

- Open CORA Chat: Once approved, navigate to the dashboard and open the CORA chat feature.

- Ask Questions: You can directly interact with CORA by typing your questions. For instance, ask CORA about various insurance topics or inquire about the TRON and TRON DeFi platforms as they are integrated into our system.

- Testing via Telegram:

- Join Our Telegram: For a broader community interaction, join our Telegram group where CORA is also accessible.

- Interact with CORA Bot: Simply type

@AInsureCora_botin the Telegram chat to start a conversation. - Ask Anything: You can ask CORA about insurance-related queries or get information about TRON and TRON DeFi platforms. For example, you might ask, “@AInsureCora_bot, what is homeowners insurance?” or “@AInsureCora_bot, how does TRON DeFi work?”

Both methods offer an easy and intuitive way to test and engage with our AI-driven insurance platform. Feel free to explore and provide feedback to help us refine and improve our solution!

For users who can’t zoom viewing the site on mobile:

ANDROID

ensure you have Desktop Mode or Desktop Site enabled under settings (3 dots, top right corner, next to address bar) - https://ainsure.app

IOS

tap ‘AA’ in address the address bar (on the right) then click ‘Request Mobile Website’. After the page reloads tap ‘AA’ and you will see:

‘a’ 100% ‘A’

above the address bar, tap the small ‘a’ to zoom out allowing you to pinch zoom like usual

Project Details:

https://youtu.be/K98WDhU5Diw

Project Milestones:

- AInsure (CORA) Chat Dashboard Update

update our backend to streamline integration with additional platforms. This enhancement will enable us to quickly and efficiently implement future integrations,

ensuring a seamless experience and more robust support for our users.

- First Agency live

Cora integration into metzgerinsuranceagency.com

Admin Control Center

Gives ability for AInsure to over see operations.

3)Talking AI Avatar for live chats

designed to enhance engagement between agencies, carriers, and consumers. This innovative tool offers a dynamic and interactive way to assist customers, answer queries, and provide personalized support, making every interaction more efficient and engaging.

- Add File Tool for CORA

will simplify the process of training CORA with relevant documents. This

feature allows for quick and easy uploading of files, ensuring that CORA remains well-informed and continuously improved to better serve your needs.

5)Social Media Tool for CORA

designed to enhance our engagement and outreach. This feature allows for seamless management of social media interactions, enabling CORA to connect with our audience more effectively and drive meaningful conversations across platforms.

6)Custom QR Code Generator

designed to produce high-end, branded QR codes for our marketing needs.

7)HackaTron Season 7

we will focus on the Integration Track. Our goal is to integrate cutting-edge platforms like Justlend, Sun Dex, Tronscan, and more into CORA. By doing so, we aim to enhance CORA’s capabilities, offering more comprehensive and seamless interactions. We look forward to showcasing how these integrations will drive innovation and improve user experiences.

October 8th we will showcase @ IACON 2024