@stj No worries, looking forward to watching this develop ![]()

[Update #7]

Market details api and integration

Lend stats api and integration

Token approvals and TronLink correct network checks

Able to supply and withdraw assets on nile testnet

Able to borrow and repay assets on nile testnet

Greetings stj! Your project seems to be missing details on the following. Please add them to your project. Thank you!

Please Include:

Project Test Instructions

Contract Address

[Update #9]

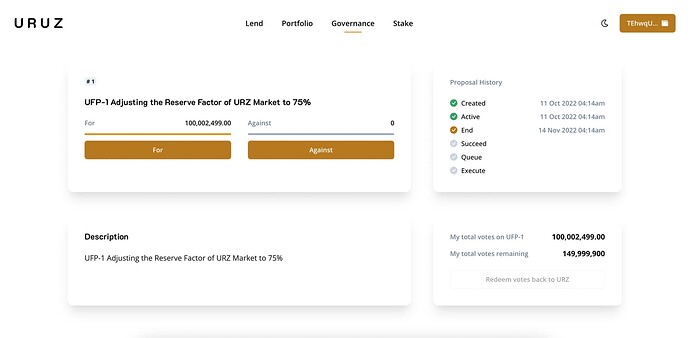

Create proposals, vote on proposal, vote balances integration

Stake integration

Domain registration and conversion

Uruz - https://app.uruz.finance/

Yes that’s really the cool path of this project I love it very well

If the uruz Smart contract triggers liquidation what are the likely result ?and again can you please tell me more about utoken ,nice project by the way i am in love with this creativity.

Hola, el proyecto es muy interesante, además en el caso que se puedan crear más activos mediante una unimidad es genial, ya que produce más competencia de ganancias e inversión.

Agradecería cuando tuviera el white paper nos lo presentara.

Hey @Mattylegend, excellent questions,

Liquidation occurs when the value of your borrowed assets (borrowing balance) is greater then your borrowing capacity (collateral factor). This happens when your collateral drops in value or when the borrowed asset rises too high in value.

Uruz smart contracts have built in functions to automatically trigger the liquidation process, however it relies on outside 3rd party systems to perform these liquidations. It incentivizes these 3rd party systems to participate (liquidate the collateral, repay the borrowed funds, and in return receive the collateral in another asset with some discount). Any TRON user can be a liquidator.

uTokens are the primary means of interacting with the Uruz Protocol; when a user mints, redeems, borrows, repays a borrow, liquidates a borrow, or transfers uTokens, he or she will do so using the uToken contract.

Hola @antonio, gracias por su interés en el protocolo Uruz. Agregar más mercados dependerá del apetito por el riesgo del DAO de Uruz en proporción a las ganancias. Lo actualizaremos cuando el documento técnico esté disponible.